Reporting for a new era

Simply Sustainable has been providing best practice guidance in ESG and sustainability reporting for over 12 years. We predict that 2023 will be the year that robust and credible nonfinancial reporting becomes the expected norm for global business.

In short, this is down to new Environmental, Social and Governance (ESG) and sustainability reporting requirements in the United Kingdom, the European Union and the United States that are set to fundamentally change the nonfinancial reporting landscape.

The Corporate Sustainability Reporting Directive (CSRD) is a new set of EU rules that will require ESG reporting on a level never seen before, capturing a whole host of companies that previously were not subject to mandatory nonfinancial reporting requirements, including public and private non-EU companies that meet certain EU-presence thresholds.

For US issuers, the new EU rules will result in mandatory reporting on a broader set of ESG topics than those required under current and proposed Securities and Exchange Commission (SEC) rules. It is important that the business community does not ignore the approaching tide of regulation on sustainability reporting that could entail significant financial and reputational damage if overlooked.

Complete the form below to read the full in-depth insight from our sustainability consultancy Thought Leadership team.

>

>Download report

Simply Sustainable’s Amsterdam office kicked off 2023 with our first sustainability leaders’ roundtable meeting. The lively discussion addressed the sustainability issues that will affect businesses in Europe in 2023. We saw extensive exchange of views and experiences between peers, looking forward to a year of empowerment and change.

Sustainability Manager is a 360-degree role

The enormous momentum behind sustainability is only expected to build further in 2023. There is an increasing demand on sustainability managers to provide practical solutions. Participants told us that many colleagues – especially those from the younger generation – come to the sustainability manager proactively with ideas (big or small) and then wish to be part of the transition, as well as board members fighting to have a piece of sustainability in their remit.

This is great news. However, in many organisations, the interest and urgency of sustainability surpasses maturity and capacity.

This imbalance is most acutely felt by sustainability managers. Theirs is becoming a 360-degree role, in which they are expected to communicate and manage to colleagues upwards, sideways and downwards, and manage stakeholders all around the business. They must work strategically as well as operationally to realise their agenda. All while the scope of their work is broadening, beyond the traditional focus on environmental issues to include social and governance topics.

Why the CSRD is sexy

The EU Corporate Sustainability Reporting Directive (CSRD) has made it much easier for sustainability managers to engage people in the organisation on sustainability. Timelines for compliance are short, and the bar is high, so many in the company recognise that preparation must start today.

Participants see that colleagues are looking to them, as the sustainability manager, to translate the complexity of the CSRD into a clear, step-by-step plan for the business.

We talked about the challenges of involving and empowering internal stakeholders in the short time span for CSRD compliance. Companies run the risk of going down a narrow route to compliance, missing the value that CSRD preparation can have for future-proofing the sustainability strategy. If full focus is on gathering the data for reporting, opportunities to engage in dialogue about the strategic implications of sustainability topics and how they are best addressed may fall by the wayside.

Sustainability data is management information

Preparation for CSRD accelerates the need for comprehensive and robust measurement. While new regulatory guidelines clarify what should be measured – previously companies had to find this out for themselves – it does not make data collection and validation any easier.

Many companies have been looking for the best system for capturing and managing sustainability data. Should they choose a new Environmental, Social and Governance (ESG) tool – of which there are increasingly many available? Can the financial reporting system be extended to include sustainability data? Or are there tried and tested Environment, Health and Safety (EHS) systems that are expanding into this space? There are many solutions out there, but companies find it very hard to judge which are robust and trustworthy.

As a widely experienced sustainability consultancy, it is our view that sustainability data should be management information and not only be used for reporting. This points to an integrated solution, that brings together financial and non-financial data for informed and balanced decision making. There is a huge need, and we are actively watching this fast-moving space to best advise our clients.

Author: Sytze Dijkstra, Netherlands Country Manager, Simply Sustainable

Download Simply Sustainable’s 2023 ESG & Sustainability Trend report for an in-depth analysis of how sustainability will shape the corporate agenda this year.

If you are interested in receiving our reports or joining a future Sustainability Leaders’ roundtable, please contact us.

The Importance of Solidarity and Collaboration in the Face of Adversity

The World Economic Forum (WEF) hosted its 53rd Annual Meeting last week from the 16-20 January 2023 in Davos, Switzerland. Cultural, business, political and other leaders of society convened at the conference to discuss actions needed to resolve current global crises, from the cost-of-living crisis to climate change, but also how to prevent the reoccurrence of these issues.

The World Economic Forum Annual Meeting 2023

Founded in 1971 and headquartered in Geneva, the WEF is committed to promoting sustainable development worldwide1. Given the many environmental, social and economic emergencies the world currently faces, this year’s meeting sought to reaffirm the importance of public-private cooperation to address these problems, as well as facilitate positive, long-term systemic change. Consequently, at the heart of the meeting, there was a desire to find ways to reinstitute a collective sense of agency and to turn defensive measures into proactive, vision-driven policies and business strategies. Key heads of state and government, as well as different geopolitical and geoeconomic groups (e.g. the Country Strategy Dialogues), contributed to discussions over the course of the four-day meeting; the WEF’s foremost business communities, such as the International Business Council and the Community of Chairpersons, also gathered to engage in discussion with their peers2.

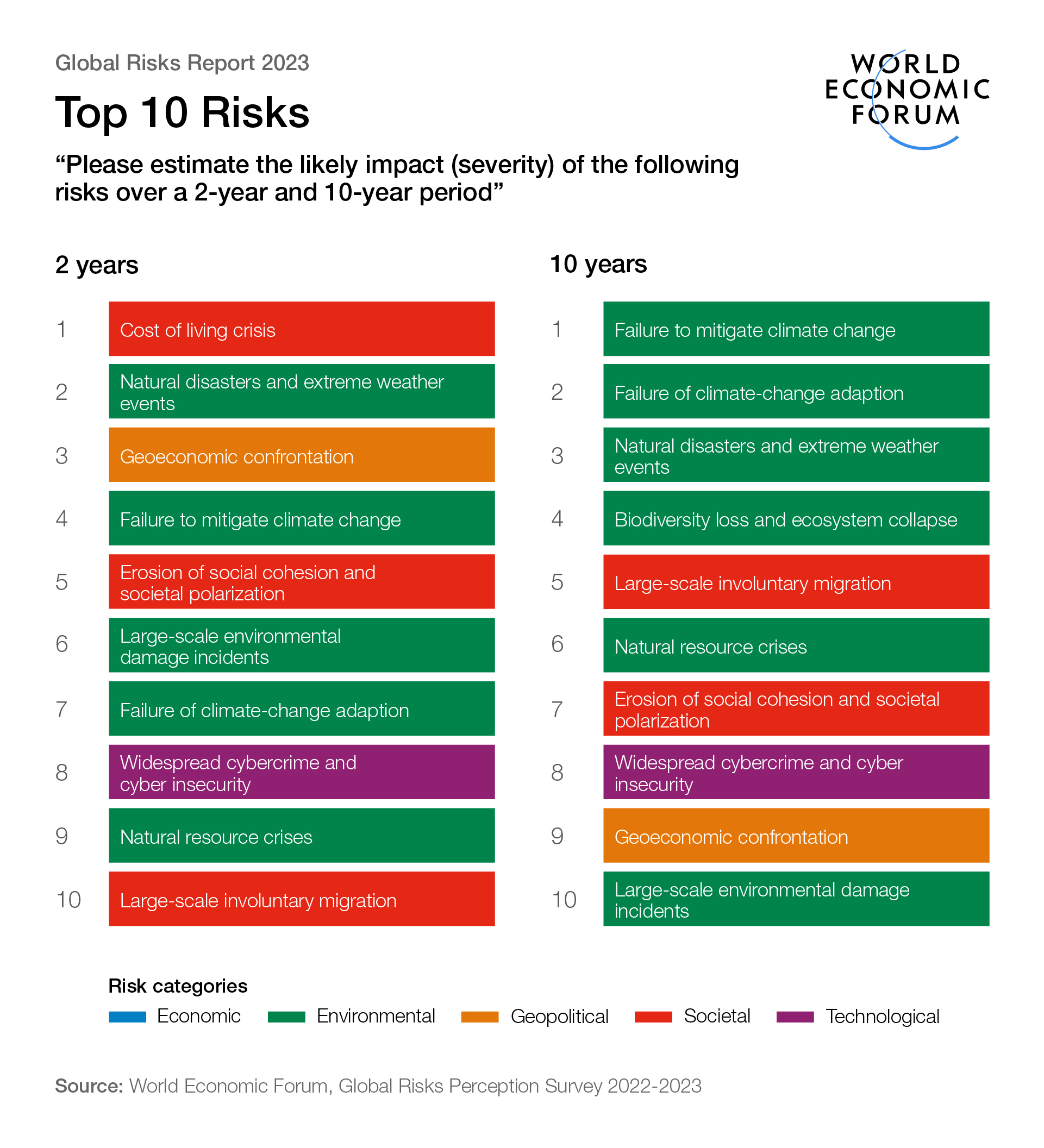

The backdrop to the 53rd Annual Meeting: the WEF Global Risks Report 2023

The WEF Global Risks Report 2023 was published in January 2023 and highlights the different areas where the world is at a critical inflection point. In its 18th edition, the results of a Global Risks Perception Survey (GRPS) are presented, which collected responses from over 1,200 experts across academia, business, civil society, government and the international community on the evolving global risks landscape in the short-term (two years) and long-term (10 years). Complementing GRPS data on global risks, the report also draws on the WEF’s Executive Opinion Survey (EOS) to identify risks that pose the most severe threat to each country over the next two years, as revealed by over 12,000 business leaders in 121 economies3.

The report revealed that energy, food, inflation and the cost-of-living crisis are considered to be the most significant global risks. The cost-of-living crisis has been ranked as the most severe global risk over the next two years, followed by natural disasters and trade and technology wars. However, failure to mitigate and adapt to climate change were ranked as the two most pressing risks over the next 10 years, with biodiversity loss and ecosystem collapse regarded as one of the most rapidly escalating global risks in the long-term. Geoeconomic confrontation, cyber insecurity, widespread cybercrime, large-scale involuntary migration and the erosion of social cohesion and societal polarisation are global risks that all feature in the top 10 over the next decade3.

A call for urgent and collective action

Despite the range of risks that are occurring simultaneously worldwide, a shift away from a focus on short-term results (i.e. “short-termism”), crises-driven mindsets and solo approaches is a strong step to effectively manage and limit their consequences. The WEF has identified four key principles that are crucial to prevent a worsening of the risks outlook3,4:

- Although risks may have short- and long-term impacts, leaders must revaluate their perception of risk and act in the shortest timeframe possible (i.e. today) to address them. In today’s risk landscape, this means leaders must collaborate now to address climate and socioeconomic issues.

- There is a need for business and governments to invest in multi-domain, cross-sector risk preparedness by building societal resilience through financial inclusion, health, care, education, and climate-resilient infrastructure.

- The abundance of crises affecting humanity and the environment has caused nations to operate in a more insular manner. Despite the importance of national preparedness, there is a fundamental need for international coordination, data sharing and knowledge exchange to deal with several global risks, such as technology governance and climate change.

- Accurate predictions of risk in terms of timescale and impact must be bolstered at a global, national and institutional level. To strengthen the ability of leaders to better understand global risks, scenario analyses, scanning multistakeholder perceptions, appointing a risks officer function, and finding data on weak signals are all valuable ways to aid leaders in this process.

What does this mean for our future?

The world is facing several sustainability challenges that present an immediate threat to humanity and nature3. Given the scale, complexity and urgency with which they need to be addressed, pessimism and a feeling of futility abounds. Nevertheless, it was clear from the WEF’s 53rd Annual Meeting that international cooperation, holistic approaches and solidarity are key to tackling and preventing sustainability crises.

Bold leadership and cohesion across country borders is needed to improve the state of the world. If we all work together now, there is good reason to feel hopeful and optimistic about the future.

Author: James Beiny, Consultant at Simply Sustainable

1. https://www.weforum.org/about/world-economic-forum

2. https://www.weforum.org/events/world-economic-forum-annual-meeting-2023/about/meeting-overview

3. https://www3.weforum.org/docs/WEF_Global_Risks_Report_2023.pdf

4. https://www.weforum.org/agenda/2023/01/davos-2023-global-risks-report-how-to-solve-the-world-s-biggest-crises/

At Simply Sustainable, we understand that sustainable growth is the only way to build a prosperous business that has a lasting positive impact on our environment and society.

The past few years have been pivotal for the ESG and sustainability revolution. It continues to be an area of focus for stakeholders at all levels – investors, regulators, businesses and consumers – despite the current backdrop of a turbulent economy and cost of living crisis.

In 2022, we saw a rise in important conversations and the development of global regulation aimed at improving sustainability, particularly across ESG and sustainability reporting and greenwashing.

The key sustainability trends for 2023, across various sectors, will remain focused on the credibility of claims and robust disclosure and reporting.

In addition, there will be greater attention on carbon reduction, a strategic focus on understanding what the transition to a low carbon economy means for business and its stakeholders, as well as moving away from using carbon offsets as a credible means to decarbonise.

Regulators have been exercising greater scrutiny of corporate sustainability efforts, fuelled by concerns that companies and asset managers may be using disclosures and sustainability-related labels on products and services as a marketing tool to appear more proactive on ESG issues than they truly are.

Complete the form below to read the full in-depth report from our Thought Leadership team:

>

>Download report

Since 2010, Simply Sustainable has developed corporate sustainability strategies for some of the biggest brands in the world.

Over the years, we have learned a thing or two about what makes a robust sustainability strategy, and we have created this guide to share our learning with you.

Whether you’re starting with a blank page, refreshing your existing approach, or are just keen to see how your organisation measures up, here you will find what we have come to understand to be the hallmarks of a truly robust sustainability strategy.

To read our in-depth analysis, please complete the form below:

>

>Download report

Beyond reporting: How companies can use the CSRD as an accelerator of their sustainability agenda

The future of corporate sustainability reporting is taking shape. At the end of November 2022, the European Union Council gave its final approval to the Corporate Sustainability Reporting Directive (CSRD)1 and the European Financial Reporting Advisory Group delivered the first set of draft European Sustainability Reporting Standards (ESRS) to the European Commission.2 With these measures, the EU aims to accelerate the transition to a sustainable economy.

Under the new CSRD regulation, companies will soon be required to publish detailed information on sustainability matters. This will increase a company’s accountability for its impacts on the environment and society, and provide financial institutions with comparable, verified information on sustainability performance that should facilitate allocation of finance to sustainable activities.

The measures should also equip companies for implementing their own sustainability agenda. They can only make progress if they know where they stand – relative to their ambitions as well as their peers – and where they can improve.

What does CSRD compliance entail?

CSRD extends the scope and detail of the current Non-Financial Reporting Directive (NFRD). It will apply to all large EU and non-EU companies (listed and non-listed) operating within the EU market.3 Companies subject to CSRD will need to:

- Disclose principal actual or potential impacts related to the company’s own operations and the implementation and outcome of the due diligence process of the company’s value chain

- Describe the role of management boards and supervisory boards regarding sustainability matters

- Disclose set time-bound targets on sustainability matters and report on the progress of achieving such targets (KPIs)

- Assess and report both impacts of the company’s activities on sustainability matters and on sustainability matters affecting the company (the double-materiality principle)

- Obtain limited assurance opinion by a statutory auditor of reported sustainability information.

However, CSRD is about much more than just reporting

Preparing for CSRD compliance will force companies to revisit their strategic focus and bring a greater systematic approach to corporate sustainability, using common standards and frameworks. The required double-materiality assessment, for instance, can identify important topics that have previously been overlooked in corporate strategy and risk management. Target setting, as prescribed by the regulation, often kicks-off a process of redesigning performance management, defining new KPIs and setting up new systems and processes for measuring and monitoring progress.

CSRD compliance is a multi-year journey

Companies need to start planning their journey to becoming fully compliant by the time the Directive is mandatory to them, ranging from between 2024 to 2026. That may appear like a lot of time, however getting all the required elements in place will be a significant exercise for many companies.

Fortunately, many elements of the CSRD build on existing standards, including the GRI framework and the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, and there is an increasing body of experience of how to apply these robustly.

Even with existing guidance, much of the detail is still to be defined. Experience suggests that general, cross-industry standards need industry-specific guidance to account for sectoral differences.

Assessing the impacts of business activity will be very different in sectors where assets are mostly intangible, in comparison to in an industry that has substantial tangible assets. Appropriate governance structures in highly competitive industries may not be suitable for regulated industries. There is also a steep learning curve in creating standards for linking sustainability performance metrics to accounting metrics like CAPEX, OPEX and turnover, as prescribed by the EU Taxonomy.

Figuring all of this out will take time and close collaboration between companies and regulators, value-chain partners and industry bodies. It will get easier as practice builds, with companies benefiting from the learning experience of early adopters.

An historic opportunity

CSRD will be challenging to implement at pace within corporations and across value chains. It is also an historic opportunity to lean-in and tool-up for a more sustainable future.

Importantly, companies should look beyond regulatory compliance when preparing for CSRD. Next to gathering information for providing accountability externally, companies must create decision-ready data that guides a shift in corporate practices, and in turn delivers real-world impact.

What does this mean in practice?

- The assessment of material sustainability issues, risks and opportunities is fully integrated into business strategy and risk management processes, and is not a paper exercise for reporting purposes only

- Targets come with execution plans that lay out the journey of meeting them, in realistic, practical steps

- Communication internally to employees is as important as communication to external stakeholders. Employees are the primary agents that will deliver sustainable business in practice, and many are eager to do so.

Approached with this mindset, preparation for CSRD can be an accelerator for delivering corporate sustainability goals, rather than a time-consuming distraction. Done correctly, it will help large companies secure the long-term resilience of their business and of the environment that it depends on.

How Simply Sustainable can help

Our growing team of expert sustainability and ESG consultants are here to enable your company to adapt at pace to the changing landscape of sustainability legislation and transformational plans towards our shared goal of net-zero.

Book a call back to discuss your strategy here

1. www.consilium.europa.eu/council-gives-final-green-light-to-corporate-sustainability-reporting-directive

2. www.onetrust.com/efrag-eu-sustainability-reporting-standards

3. A company is considered ‘large’ and subject to the CSRD if it meets two out of three criteria: (1) revenue over EUR 40 million; (2) total assets over EUR 20 million; (3) more than 250 employees.

Business as usual cannot be sustained

Momentum towards sustainability has reached a tipping point. From a business context, it is now permanently on the majority of company agendas.

The path ahead will be far from ‘business as usual’.

Planning and delivering the required transformation and incorporating measures that will make a business more resilient, competitive and relevant, in a marketplace with increasingly demanding sustainable solutions. Companies that thrive will have fully embraced the need for transformative change, as a means to become ‘future-fit’.

In the document we detail why the need for transformation is now, at pace and at scale and how we at Simply Sustainable work with businesses to enable this change in all aspects of business; bringing together decades of transformational and sustainability expertise.

Business has a crucial part to play not just as economic engines, but in minimising negative environmental impact, maximising social benefits and in enabling a more sustainable world.

>

>Download report

Much attention is being given to the environmental claims that businesses make when marketing their products and services. As demand for eco-friendly products skyrocket, in the UK alone, one third of consumers want to shop responsibly by choosing more environmentally friendly products and services.1 By exploiting consumer’s genuine ethical concerns, greenwashing impacts a consumer’s ability to make a sound environmentally friendly decision – generating confusion, scepticism and increased perceived risks around ‘green products.’ As stakeholders are increasingly exposed to the material risk of greenwashing, how are the businesses that are responsible held to account?

There are many statements made about the environmental and sustainable credentials – nicknamed green claims – of products in advertising, packaging, and other marketing materials. Getting these wrong is bad for business, bad for consumers and bad for the planet. That’s where we, whether consuming as an individual or on behalf of an organisation, need assistance to better understand and trust green claims. In September 2021, the Committee of Advertising Practice launched the Green Claims Code. The principles are designed to highlight the standards that businesses need to adhere to when making claims about their environmental impacts.

The rules are simple, claims must:

- Be truthful and accurate

- Be clear and unambiguous

- Not omit or hide important and relevant information

- Be fair and meaningful when comparing to competitor

- Consider full life cycle of product or service

- Be substantiated.

So, what do these six principles set out for businesses and who is affected?

The code helps businesses understand and comply with best practice around marketing and advertising. By supporting the Advertising Standards Agency (ASA), the code enforces new guidance on misleading and socially irresponsible environmental claims. By delivering clear and explicit instructions, the entire lifecycle of a product, service, process, or brand is covered by the code. A tough route for a business to navigate when faced with the current macroenvironment of supply chain issues, inflation and rising cost of living impacting a volatile labour market.

Beyond the legal penalties for failing to comply, neglecting these six principles risks separating a company from their customer base. And as informed public opinion and expectations rapidly evolve, a company’s reputation is increasingly exposed to this danger. Over a 12-month period, the ASA found 16 advertising campaigns had either exaggerated their company’s green credentials or made unsubstantiated environmental claims. 2 Major companies caught up in this scandal included Innocent Drinks, Oatly and Alpro.3 Other household names such as Amazon, Ikea and Unilever were among companies to be exposed to fall short of promises that reach net-zero by the middle of the century.3 Showcasing the increased stakes of marketing credibly, with action by regulators such as CMA set to grow.

As trust in green claims is fragile, the Green Claims Code is a welcomed intervention that will play a vital role in levelling the playing field. Bridging the gap between marketing and sustainability requires a big shift in mindset. Businesses that have been doing the work to mitigate their social and environmental impact – with data to support – will see the code as a golden opportunity to gain commercial advantage and improved performance.

At Simply Sustainable, we support the current trends of increased transparency in disclosures and can guide you to comply with existing obligations on environmental claims.

[1] Forbes. One third of UK consumers want to shop responsibly.

2 Independent. Number of adverts banned for ‘greenwashing’ triples in a year.

3 The Guardian. Biggest net zero claims.

Climate change remains the most important challenge for our generation and businesses face the challenge of setting meaningful targets that provide clear incentives to mitigating the effects of global warming. According to the World Meteorological Organisation (WMO),[1] the most relevant consequences of global warming are:

- Increase of frequency and intensity of natural disasters.

- Low air quality and health issues for people living in urban environments.

- Scarcity of natural resources and variability of weather conditions.

Evidently, these have a massive impact on the economy and the wellbeing of communities around the world. The UN Environment Programme estimated that the cost for adaptation and resilience to climate change amounts to $140-300 billion USD per year until 2030. This illustrates the economic value, both directly and indirectly, of the climate emergency and the threat to all communities and industries.[2]

To find a way to face it, the first step is to be aware of the amount of Greenhouse Gas (GHG) emissions we release into the atmosphere. This concept is known as carbon footprint, which can be applied for any product, person, service, company, process or even a country.

Today, many businesses are responding to stakeholder pressure by making commitments to reduce their impact on the environment and boost overall sustainability. After COP26 climate summit in Glasgow[3], more than 150 countries committed to new climate plans to contribute achieving net zero carbon emissions by 2050. Through an ambitious strategy of decarbonisation, reduction targets were set for each decade backed by bold and credible actions.

Being carbon accountable can help companies to:

- Comply to increasing government regulations and standards.

- Meet stakeholder expectations, most importantly the public.

- Identify and prevent financial risks related to climate change.

- Obtain the information to define a strategic plan for emission reductions and decarbonisation.

- Build a strong reputation and added value for investors and customers.

The GHG Protocol is considered the best practice known in the industry to calculate carbon footprint. It helps standardising a comprehensive global framework that assesses emissions from private and public sector operations and value chains. This is useful for businesses to provide accountability on their performance and guidance on their hotspots and areas of opportunity, allowing them to take mitigation actions in a strategic way.

In 2021, more than 9 out of 10 Fortune 500 companies used GHG Protocol directly or indirectly.[4] Therefore, we recommend our clients to use it as their framework for their carbon accounting. According to this standard, carbon emissions are classified in 3 categories depending on where their source come from[5]:

- Scope 1: Direct emissions from owned or controlled sources e.g. on-site electricity generation, heating, cooling, company owned vehicles, fugitive emissions (e.g. refrigerants), agricultural emissions.

- Scope 2: Indirect emissions from the generation of purchased energy e.g. imported electricity, steam, chilled water.

- Scope 3: All other indirect emissions that occur in an organisation’s value chain e.g. purchased goods and services, employee commuting, business travel, upstream emissions from fuel extraction, waste management.

At Simply Sustainable, we help our clients to have a detailed understanding of their carbon performance and to identify the main opportunities to achieve significant emission reductions. Our approach consists in five steps:

- Operational review: gaining an in-depth understanding of your business, your context and status in the carbon journey.

- Determining boundaries: determining which emissions and activities should be within your emissions boundary.

- Gathering of data: Identifying the appropriate collection mechanisms and spreadsheets.

- Calculating footprint: Calculating emissions for a chosen baseline year to international standards.

- Hotspots and reporting: Identifying opportunities within your business operations that have the highest carbon output.

The calculated carbon footprint gives information to build a net zero road map, and it can be used for responding to annual reports, Streamlined Energy and Carbon Reporting (SECR)[6], Carbon Disclosure Project (CDP)[7] and Task Force on Climate-related Financial Disclosures (TCFD)[8].

From commitment to action, we are with you every step of the way on your journey to reducing your carbon footprint.

[1] World Meteorological Organisation. What is climate change?

[2] UN Environment Programme Adaptation Gap Report 2021

[3] UN Climate Change Conference UK 2021 COP26 Goals

[4] Greenhouse Gas Protocol . About GHG Protocol

[5] Carbon emissions breakdown. Compare your footprint.

[6] Education & Skills Funding Agency. Guidance: Streamlined Energy and Carbon Reporting (SECR).

[7] Carbon Disclosure Project. Guidance & questionnaires.

[8] Task Force on Climate-related Financial Disclosures. Final Report 2017.

The imperative for action on carbon is growing – the political and economic climate reflects this

The term ‘net-zero’ has saturated the business landscape prior to and post COP26; however, many businesses we encounter don’t fully understand what it means to be net-zero and the steps they need to take to decarbonise. Some organisations are deterred from attempting to explore the steps required because it is considered expensive and unattainable. Others perceive the net zero sustainability solution to be easily solved via carbon offsets, through means such as decarbonisation agriculture.

This document consolidates our knowledge in this area to make it simple for businesses to understand how they can achieve net-zero and how we can help navigate some tricky areas.

>

>Download report

>

>Request a call-back

"*" indicates required fields